risks cheaper car insurance vehicle trucks

risks cheaper car insurance vehicle trucks

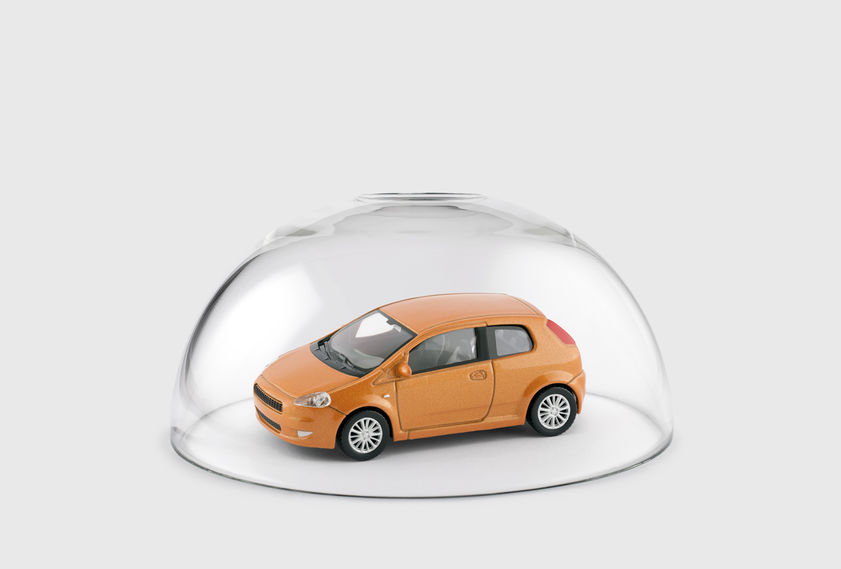

If you don't lug required car insurance coverage, you can deal with charges also if the accident had not been your mistake - cheapest car insurance. If you're driving without valid car insurance policy and you're associated with a cars and truck accident, right here's what to understand at the start: The truth that you're an uninsured vehicle driver does not have any type of effect on a crucial element: that was at mistake for the crash (low-cost auto insurance).

Call local legislation enforcement to the scene. Do not confess mistake for the accident, and also don't talk about any information concerning the crash - cheap car.

Take photos of the accident scene, the position of the lorries, as well as anything else that could aid inform the story of exactly how the accident happened. It's crucial to maintain things in viewpoint below.

cheapest auto insurance cheap car insurance insurance affordable affordable auto insurance

cheapest auto insurance cheap car insurance insurance affordable affordable auto insurance

Several states have some variation of a "No Pay, No Play" law. affordable auto insurance. In those states, if you did not have legitimate automobile insurance policy in position at the time of the crash, you're limited in the types of settlement you can obtain for your injuries, and in a couple of states (like New Jacket) you can't recover anything against the at-fault vehicle driver. credit score.

The reasoning behind "No Pay, No Play" laws is that if you do not have the required vehicle insurance coverage that might offer complete settlement to another person, then you shouldn't have the ability to claim the complete benefits of somebody else's insurance if you have actually been the target of a car mishap. What If I'm at Mistake for the Mishap? The answer here depends on whether you live in a no-fault vehicle insurance state, or a state that complies with conventional fault (or "tort") concepts when it involves automobile insurance - auto insurance.

Our What Happens If I Don't Make My Premium Payment By The End ... Statements

It is no defense to these legal actions to inform the court, "I can not pay that quantity." If you are found liable after a test as well as you are bought to pay the various other motorist's problems, a judgment will certainly be entered against you (a lot more on this listed below). States that do not comply with a "no-fault" insurance policy systemthis indicates the huge majority of statesare called "tort" states. car insurance.

This might consist of medical costs, lost incomes, property damage, and physical and also psychological pain and also suffering (cheaper). If you do not have a vehicle responsibility insurance coverage, you are personally in charge of paying these damages to the wounded person - accident. Simply put, you will need to pay them out of your own pocket.

vehicle insurance dui insure business insurance

vehicle insurance dui insure business insurance

Fines for Driving Without Automobile Insurance Policy If you are in a car accident and discovered to be driving without legitimate insurance coverage, every state will certainly enforce a fine of hundreds or perhaps hundreds of bucks. vehicle insurance. Furthermore, the Department of Electric Motor Automobiles in a lot of states will likewise enforce penalties that include the suspension or abrogation of your driver's certificate, normally for a period from a few months to one year. cheaper car.

Obtaining Assistance After an Auto Crash If you've been in an automobile accident while driving without insurance, you might be in for a battle on a number of possible fronts. auto. If the various other vehicle driver (or their insurance coverage business) is attempting to put the blame for the accident on you, there's a lot at stake for you monetarily, particularly if the various other vehicle driver was seriously damaged.

credit score insurance insure insurance

credit score insurance insure insurance

Despite the specifics of your circumstance, you might intend to begin by getting to out to a vehicle crash attorney in your area. An experienced attorney can consider the particular circumstances of your scenario and also explain your alternatives. You can utilize the devices on this Click for info web page to link with a neighboring legal representative.

The Ultimate Guide To What To Do If Car Insurance Is Canceled For Nonpayment

In lots of states, that implies buying just liability coverage (which relates to injuries as well as vehicle damages incurred by other individuals in a mishap triggered by you) - credit score. While this approach will certainly save you money in the short-term, bear in mind that obligation coverage can not be made use of to cover your own automobile accident injuries or damages to your own automobile.

Some state insurance coverage departments are motivating or buying companies to momentarily do several of the following: Not fee late costs or various other penalties. Develop flexible layaway plan. Pause policy cancellations for nonpayment. Expand moratorium, typically a 30-day duration after settlement is due when you can still pay as well as will not lose insurance coverage."It is very important to call the insurance provider, explain the circumstance as well as see if they can give any type of type of alleviation.

See what you might minimize automobile insurance coverage, Conveniently compare personalized prices to see just how much changing vehicle insurance can conserve you. Vehicle insurance, Many states call for vehicle drivers to have vehicle insurance, which suggests shedding coverage is not a lawful alternative unless you stop driving. You can take advantage of COVID-19 car insurance coverage refunds or make modifications to your plan - affordable car insurance.

Allstate is offering a standard of 15% back to auto insurance coverage clients for premiums paid in the months of April, May and June. State Ranch is functioning to establish an 11% average price cut for policies in all states. As a last resource, you can consider minimizing coverage - auto insurance.

If you have an auto loan or lease, your agreement likely requires detailed and also collision insurance policy (low cost). If you aren't driving your cars and truck in all during the pandemic, as well as don't have a funding or lease on it, other choices include: Reducing coverage to comprehensive-only insurance, which protects your car from damages while it's saved - cheapest.

Everything about What Happens If You Don't Pay Your Car Insurance?

If you have term life, you'll likely lose coverage if you can not pay after the poise period. Nevertheless, if you have a permanent life plan as well as want to maintain it, you have extra options. Numerous whole life plans have integrated alternatives to pay your premium in other means.